Retirement Planning Explained: Using the ApexHub Retirement Planner to Model Future Income

The ApexHub Insights Retirement Planner helps you determine if your savings and investments are enough for retirement. It models your pension, brokerage portfolio, and living expenses to estimate how long your money will last. The tool also compares a fixed-rate model versus a realistic volatility-adjusted simulation to guide you toward a sustainable retirement plan.

Step 1: Define Your Financial Details

Visits Our Retirement Planner, and enter the following data:

- Pension Initial Balance (KSh) — e.g., NSSF or other retirement fund.

- Brokerage Initial Balance (KSh) — e.g., stock or unit trust portfolio.

- Annual Expenses in Retirement (KSh) — what you plan to spend annually.

- Other Annual Income (KSh) — e.g., rental or business income.

- Current Age, Retirement Age, and Life Expectancy.

- Inflation Rate (%) — expected cost of living increase.

- Investment Returns (%) for both pension and brokerage accounts.

- Tax Rate (%) on any other income.

Then click Run Projection to see if your savings can sustain your lifestyle throughout retirement.

Example 1: Without Considering Market Volatility

Inputs

- Pension: KSh 500,000

- Brokerage: KSh 700,000

- Annual Expenses: KSh 1,100,000

- Other Annual Income: KSh 100,000

- Current Age: 30

- Retirement Age: 60

- Life Expectancy: 80

- Inflation: 5%

- Pension Return: 4%

- Brokerage Return: 10%

- Tax Rate: 7.5%

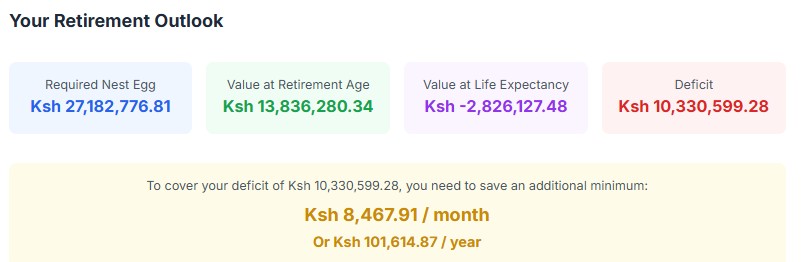

Results

- Required Nest Egg: KSh 27,182,776

- Projected Value at Retirement: KSh 13,836,280

- Projected Value at Life Expectancy: KSh -2,826,127

- Deficit: KSh 10,330,599

- Recommended Monthly Savings: KSh 8,468

This means the investor needs to save KSh 8,468 per month or KSh 101,615 annually to close the retirement funding gap.

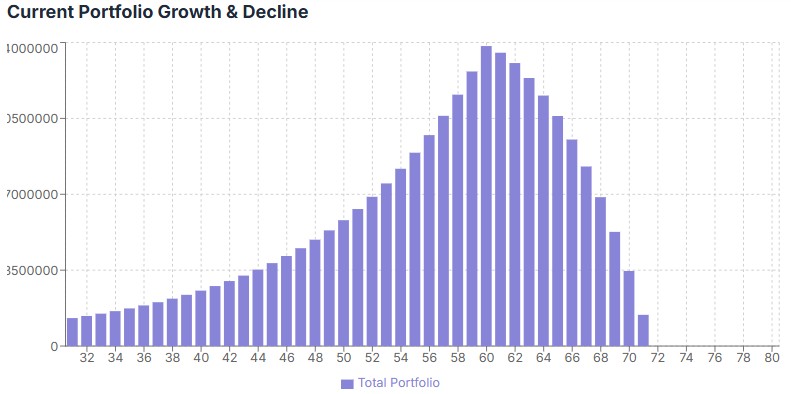

Portfolio Growth (Deterministic Projection)

At age 60, total savings reach KSh 13.8 million, but expenses quickly deplete the portfolio by age 72. The shortfall highlights the impact of fixed assumptions that ignore market ups and downs.

Example 2: After Considering Market Volatility

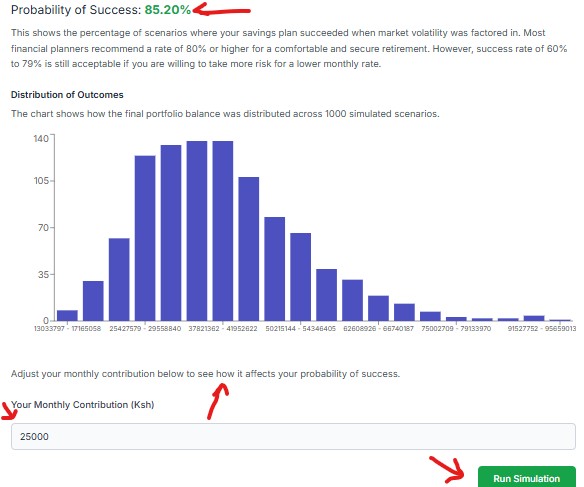

The same financial details are run through 1,000 simulated market scenarios using variable returns to reflect real-world market fluctuations.

Results (Simulation)

- Probability of Success: 85.20%

- Recommended Monthly Savings: KSh 25,000

Distribution of Final Outcomes (Across Simulations)

A success rate above 80% is generally considered a healthy benchmark for long-term retirement security. Increasing savings from KSh 8,468 to KSh 25,000 per month significantly improves the chance of not running out of money during retirement. Note you can change the monthly contribution and run simulation again to see different results.

Interpreting the Results

- Without Volatility: The model assumes stable, predictable returns. It provides a baseline but may underestimate future risks.

- With Volatility: Simulations reflect realistic investment uncertainty, showing a range of possible outcomes. This is more practical for long-term planning.

Key Terms

- Required Nest Egg: The total savings needed by retirement to meet expenses.

- Projected Value: Estimated total portfolio value at retirement age.

- Deficit: The shortfall between the required nest egg and projected value.

- Probability of Success: Likelihood that savings will cover lifetime expenses under market variability.

Why It Matters

- Employees understand if NSSF and personal savings are sufficient.

- Investors can test different contribution levels or investment returns.

- Advisors can simulate client portfolios to visualize outcomes.

- Planners can assess how inflation and longevity affect wealth sustainability.

Assumptions

- Inflation is assumed constant throughout the model.

- Investment returns are fixed averages in the deterministic case and variable in the simulation.

- A flat tax rate is applied for simplicity.

- Annual expenses grow with inflation.

Summary

The ApexHub Insights Retirement Planner allows you to visualize your financial path toward retirement. Start with your current savings and adjust contributions to see how inflation, investment returns, and volatility affect your outlook.

Check your plan now at Retirement Planner and take control of your financial future with data-driven confidence.