Kenya Personal Income Tax Explained: How to Calculate Your Net Pay Accurately

Understanding how much tax you pay each month helps you plan your finances better. The ApexHub Insights Personal Income Tax Calculator lets you estimate your monthly take-home pay based on the latest Kenyan tax regulations. It factors in all major deductions, reliefs, and pension benefits.

What the Calculator Does

The calculator helps you compute your net salary by considering:

- Gross Monthly Salary (KES) — your total income before deductions.

- Pension Contributions (Optional) — deductible up to KES 30,000 per month.

- Mortgage Interest (Optional) — deductible up to KES 30,000 per month.

- Post-Retirement Medical Fund (PRMF) Contributions (Optional) — deductible up to KES 15,000 per month.

- Life Insurance Premiums (Optional) — relief up to KES 5,000 per month.

Once you enter these details, the calculator instantly displays your net monthly pay after applying all allowable deductions and reliefs under current law.

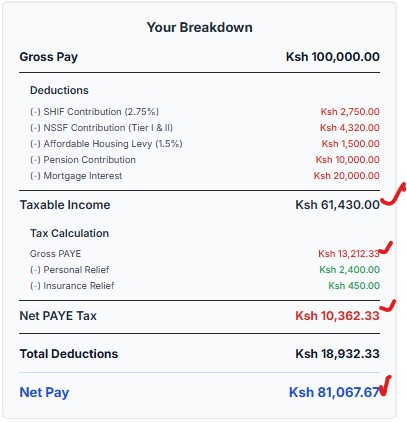

Example 1: Mid-level Employee

- Gross Salary: KES 100,000

- Pension Contribution: KES 10,000

- Mortgage Interest: KES 20,000

- Life Insurance Premium: KES 3,000

Result:

- Taxable Income: KES 61,430.00

- Gross PAYE Tax: KES 13,212.33

- Net PAYE Tax: KES 10,362.33

- Estimated Take-home Pay: About KES 81,067.67

This helps employees understand how deductions and reliefs reduce total tax payable.

Example 2: High-Income Professional

- Gross Salary: KES 250,000

- Pension Contribution: KES 30,000

- Mortgage Interest: KES 25,000

- PRMF Contribution: KES 10,000

- Life Insurance Premium: KES 5,000

Result:

- Taxable Income: Around KES 170,055.00

- Gross PAYE: KES 45,799.83

- Net PAYE: KES 42,649.83

- Net Take-home Pay: Roughly KES 192,405.17

Thus, the tool quickly shows how higher deductions under pension and mortgage reduce taxable income, leading to meaningful savings.

Why It Matters

- Employees can plan take-home pay and manage monthly budgets.

- Employers can estimate payroll obligations and ensure compliance.

- Financial advisors can use the tool to show clients the benefit of tax planning.

- Analysts can model different income scenarios for budgeting or HR planning.

Practical Use

- Visit ApexHub Insights Personal Income Tax Calculator.

- Enter your gross salary and any deductions or reliefs.

- Review your projected take-home pay and effective tax rate.

- Adjust your pension, mortgage, or insurance inputs to see how they affect your net income.

Summary

The Personal Income Tax Calculator helps you take control of your finances. It simplifies complex tax computations into a clear monthly breakdown. Whether you’re an employee, HR officer, or financial planner, this tool saves time and helps you make informed salary and deduction decisions.