Debt Payoff Strategies Explained: How to Use the ApexHub Calculator to Become Debt-Free Faster

Managing multiple debts can feel overwhelming. The ApexHub Insights Debt Payoff Calculator helps you organize and compare repayment strategies, showing how different methods affect your total payments, interest, and timeline. It transforms complex calculations into a clear, visual roadmap toward financial freedom.

What the Calculator Does

The calculator lets you:

- Enter each debt, including lender name, balance, interest rate, payment, and term.

- Add extra payments to see how they accelerate payoff.

- Compare strategies:

- Debt Avalanche — pay highest interest first.

- Debt Snowball — pay smallest balance first.

- Shortest Term First — clear debts with the shortest payoff period.

- Custom Order — choose your own repayment sequence.

You can save and load debt data locally on your browser for convenience.

Example: Multiple Debts, One Plan

An individual with five debts inputs the following data:

| Lender | Balance (KES) | Interest (%) | Monthly Payment (KES) | Term (Months) |

|---|---|---|---|---|

| Debt 1 | 250,000 | 15 | 25,000 | 11 |

| Debt 2 | 500,000 | 13 | 36,000 | 16 |

| Debt 3 | 100,000 | 17 | 25,000 | 5 |

| Debt 4 | 300,000 | 18 | 25,000 | 14 |

| Debt 5 | 150,000 | 16 | 10,000 | 17 |

Extra payment: KSh 25,000 once, starting November 2025.

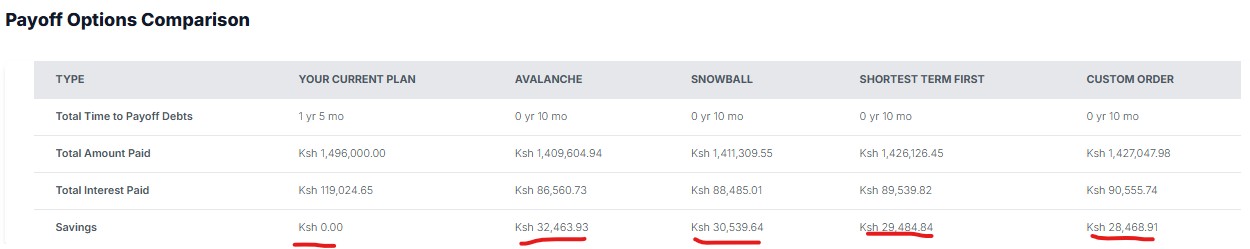

Results:

-

Current Plan:

- Time to Payoff: 1 year 5 months

- Total Interest Paid: KSh 119,024.65

- Total Amount Paid: KSh 1,496,000.00

-

Avalanche Strategy:

- Time to Payoff: 10 months

- Total Interest Paid: KSh 86,560.73

- Total Amount Paid: KSh 1,409,604.94

- Total Savings: KSh 32,463.93

This shows that using the Debt Avalanche method saves over KSh 32,000 compared to only making minimum payments and the other strategies considered here.

How the Strategies Differ

- Debt Avalanche: Focuses on paying high-interest debts first. Saves the most money long-term.

- Debt Snowball: Focuses on the smallest balances first. Builds motivation through quick wins.

- Shortest Term First: Targets debts that will be cleared soonest to simplify obligations.

- Custom Order: Lets you set your own priority based on personal or emotional preferences.

Example Progress Snapshot

| Month | Total Payment (KES) | Remaining Balance (KES) | Debt Cleared |

|---|---|---|---|

| Nov 2025 | 121,000 | 1,195,458 | - |

| Mar 2026 | 121,000 | 763,582 | Debt 3 |

| Sep 2026 | 96,000 | 251,208 | Debt 1 |

| Dec 2026 | 71,000 | 51,360 | Debt 4 |

| Feb 2027 | 46,000 | -22,806 | Debt 2 |

| Mar 2027 | 10,000 | 0 | Debt 5 |

By March 2027, all five debts are fully repaid.

Why It Matters

- Borrowers can identify the fastest or cheapest path to debt freedom.

- Financial advisors can model repayment strategies for clients.

- Analysts can compare the efficiency of different payoff methods.

- Households can make better budgeting decisions by understanding total cost.

Key Assumptions

- Interest is compounded monthly.

- Payments are made on time and in full.

- Rates remain constant.

- No penalties or lender fees included.

- All payments occur on the same monthly date.

Summary

The Debt Payoff Calculator gives you the clarity to choose the best strategy for your financial goals. It lets you visualize how extra payments and payoff methods affect your debt-free timeline.

Start your journey today at Debt Payoff Calculator and take the first step toward controlling your debt with data-driven confidence.