Loan Repayments Explained: How to Use the ApexHub Loan Calculator to Model Your Debt

Managing loans effectively starts with understanding how repayments work. The ApexHub Insights Loan Repayment Calculator helps you estimate your monthly payments, total interest, and overall loan cost before you commit to borrowing. It simplifies complex amortization math into an easy-to-read breakdown.

What the Calculator Does

You enter:

- Loan Amount (KES) — the total you plan to borrow.

- Interest Rate (%) — your annual rate.

- Loan Term (Years) — how long you’ll repay.

- Start Date — when your repayments begin.

After clicking Calculate Repayment, the tool generates a detailed summary:

- Monthly Payment

- Total Interest Paid

- Total Amount Paid

- Amortization Schedule showing how each payment covers principal and interest over time.

Example: Loan Repayment Breakdown

Loan Details

- Loan Amount: KES 240,000

- Interest Rate: 14% per year

- Term: 6 years

- Start Date: 11 March 2025

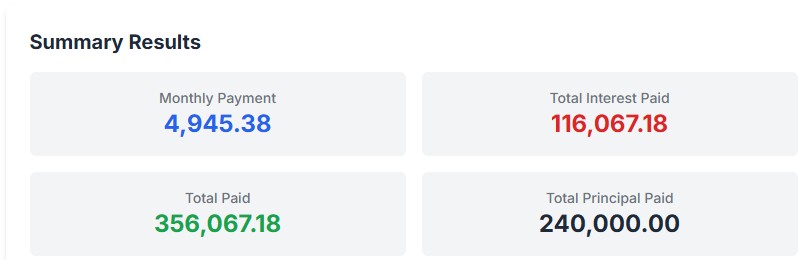

Results

- Monthly Payment: KES 4,945.38

- Total Interest Paid: KES 116,067.18

- Total Amount Paid: KES 356,067.18

- Principal Paid: KES 240,000

This means over six years, you’ll repay KES 356,067, of which KES 116,067 is interest.

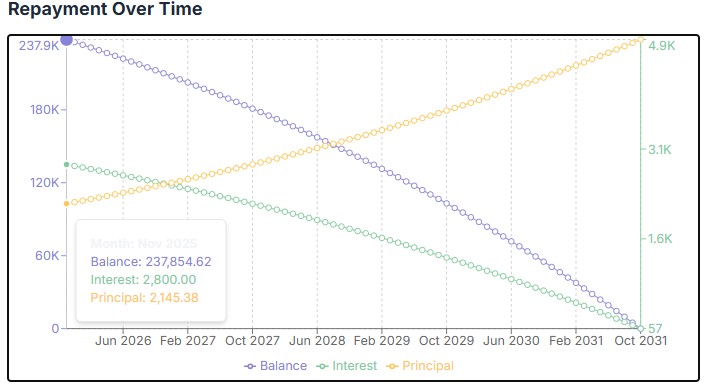

How Repayment Works Over Time

Each monthly payment includes both interest and principal.

At the start, most of your payment covers interest, while the principal reduces slowly. Over time, this reverses, more of your payment goes toward reducing the balance.

For example:

| Month | Payment (KES) | Principal (KES) | Interest (KES) | Balance (KES) |

|---|---|---|---|---|

| Nov 2025 | 4,945.38 | 2,145.38 | 2,800.00 | 237,854.62 |

| Jun 2026 | 4,945.38 | 2,326.84 | 2,618.54 | 222,119.56 |

| Dec 2027 | 4,945.38 | 2,867.08 | 2,078.30 | 175,272.75 |

| Jun 2030 | 4,945.38 | 4,060.35 | 885.03 | 71,799.57 |

| Oct 2031 | 4,945.38 | 4,888.35 | 57.03 | 0.00 |

By the final year, nearly all your payment reduces the remaining balance.

Why It Matters

- Borrowers can see the full loan cost before taking credit.

- Homeowners can compare mortgage terms and interest savings.

- Entrepreneurs can plan business loan cashflows accurately.

- Analysts can model repayment structures for financial reports.

Visual Insights

Graphs generated by the calculator show:

- How interest and principal change over time.

- The declining loan balance each year.

- Total payments versus total interest.

Adding these visuals makes repayment patterns easier to understand.

Summary

The Loan Repayment Calculator helps you plan debt responsibly. It shows how loan terms, rates, and durations affect your monthly payments and total cost. Whether you’re applying for a personal loan, car finance, or mortgage, this tool ensures you make informed borrowing decisions.

Test it at apexhubinsights.com/calculators/loan and visualize your repayment journey before you borrow.