Compound Interest Explained: Projecting Long-Term Returns for Stock, Bond, and Fund Investors

Compound interest determines how fast your investment grows when earnings are reinvested. ApexHub Insights offers an interactive Compound Interest Calculator that lets you model this effect for different assets such as stocks, bonds, and money market funds. It helps investors, analysts, and advisors turn basic inputs into actionable growth projections.

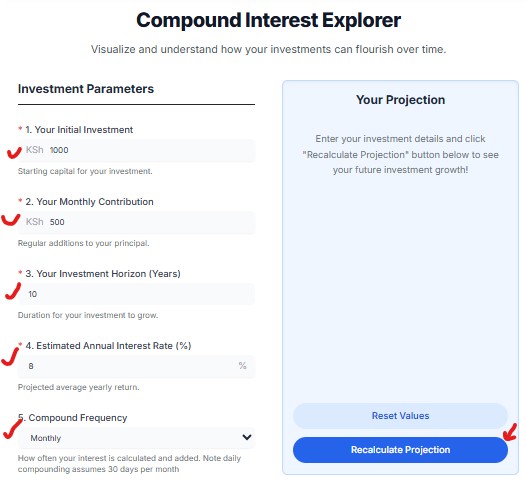

How the Calculator Works

You enter:

- Initial Investment (KSh)

- Monthly Contribution (KSh)

- Investment Horizon (Years)

- Estimated Annual Return (%)

- Compound Frequency (Monthly, Quarterly, Semiannual, Annual, or Daily)

Once you click Recalculate Projection, you see how your investment compounds over time. The projection updates instantly, helping you test multiple strategies.

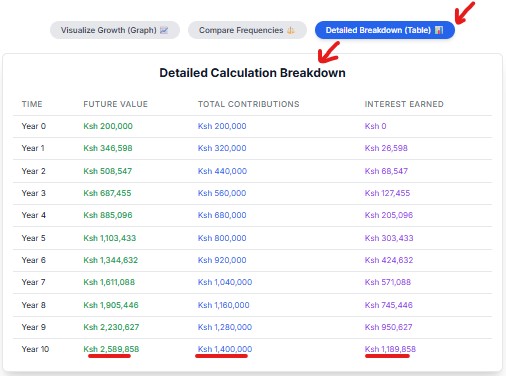

Scenario 1: Stock Portfolio Growth

An investor starts with KSh 200,000 in a diversified stock portfolio, adds KSh 10,000 per month, and expects a 10% annual return from capital gains plus dividend income (if any) compounded monthly for 10 years.

Result:

- Projected total value ≈ KSh 2,589,858

- Total contributions = KSh 1,400,000

- Compound growth adds over KSh 1,189,858 in returns.

This scenario shows how equity returns and reinvestment can multiply long-term wealth. Graphs from the calculator can visualize growth acceleration after the fifth year, where compounding becomes more noticeable.

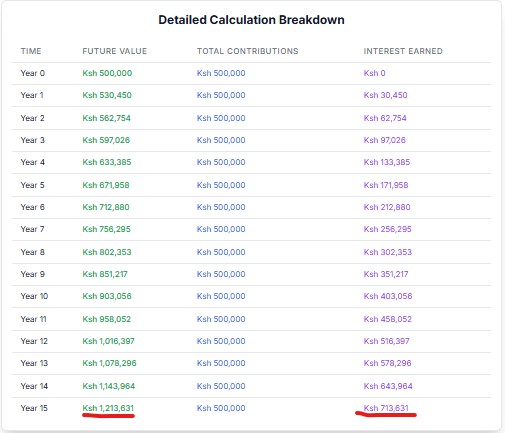

Scenario 2: Government Bond Investment

A conservative investor buys KSh 500,000 in long-term bonds, reinvesting coupon payments at a 6% annual rate, compounded semiannually, over 15 years.

Result:

- Future value ≈ KSh 1,213,631

- Steady compounding yields reliable income with lower volatility.

This model helps analysts demonstrate the trade-off between return and risk compared to equities.

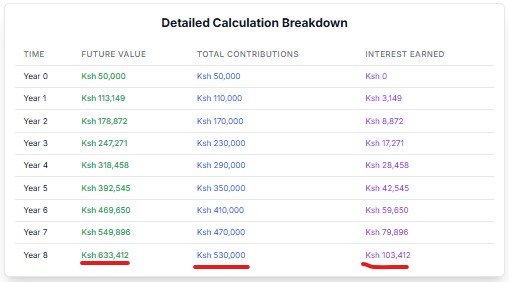

Scenario 3: Money Market Fund Savings Plan

A professional invests KSh 50,000 in a money market fund with KSh 5,000 monthly contributions, earning 4% per year, compounded monthly, for 8 years.

Result:

- Total value ≈ KSh 633,412

- Interest earned ≈ KSh 103,412

Money market funds compound slower but offer liquidity and low risk, suitable for short- to mid-term goals.

Scenario 4: Mixed Asset Strategy

An analyst models a mixed portfolio:

- 60% stocks at 10% return

- 30% bonds at 6% return

- 10% money market at 4% return

The weighted return is around 8.2%, compounded monthly. Over 12 years, this balance smooths volatility while maintaining healthy compounding effects. Tables and graphs from the calculator can show comparative growth for each asset type.

Why Compound Interest Matters

- Investors test strategies before committing capital.

- Analysts model future portfolio performance and scenario outcomes.

- Advisors use visual projections to explain long-term planning.

- Traders compare short-term returns versus compounding gains.

Summary

Compound interest rewards consistency, not timing. Whether you invest in stocks, bonds, or money market funds, reinvesting earnings accelerates growth over time. Use the ApexHub Insights Compound Interest Calculator to simulate different rates, frequencies, and timeframes.

Explore it at apexhubinsights.com/calculators/compound-interest and use your graphs and tables to turn projections into financial insight, today!