The Value of Growth: Valuing Shri Krishana Overseas PLC in Kenya’s Evolving Packaging Landscape

Introduction: why this company, why now?

In every emerging market, there comes a moment when a small company tells a story that’s big enough to matter. Shri Krishana Overseas PLC (SKL), a company preparing to list by way of introduction on the Nairobi Securities Exchange (NSE) SME Market Segment, might just be that story. While there are 50.5 million authorised shares oustanding for SKL, upon the listing, investors are expected to purchase 8.7 million of the shares at cost of KES5.90 per share.

Founded in 2009 by a husband-and-wife team, Nirmla Devi and her spouse, SKL began life as a trading company dealing in food commodities like rice and spices. But over the past decade, the company has taken a bold pivot: from trader to manufacturer, from arbitrageur to value creator. That transition, paired with Kenya’s shifting economic tides, sets the stage for this valuation.

Why now? Kenya is pushing local manufacturing through policies like Buy Kenya, Build Kenya and aiming to reduce import dependence across sectors. Simultaneously, sustainability regulations such as plastic bag bans and Extended Producer Responsibility (EPR) have ignited demand for more compliant, eco-friendly packaging solutions.

SKL’s story fits squarely into these trends. Its upcoming Kisaju plant aims to increase capacity by over 7x from 3,000 to 22,000 tonnes annually, designed to serve horticulture exporters, FMCG producers, and the informal kadogo economy. But while the growth story is compelling, the valuation begs a deeper question: is the market pricing in a dream, or a deliverable?

The business: from trade to transformation

SKL began as a trader of food products but pivoted toward packaging manufacturing. The Nairobi facility currently produces 3,000 tonnes of packaging materials annually. That is about to change.

By Q3 2025, SKL expects to commission a new 22,000-tonne capacity plant in Kisaju, Kajiado County, a 7x increase. This move is intended to:

- Serve Kenya’s growing horticulture export sector (avocados, mangoes, flowers etc.)

- Support rising demand from FMCG firms adopting small-pack formats for affordability

- Strengthen Kenya’s self-reliance in packaging inputs

The firm is also aligning with sustainability regulations, pledging to use recyclable and responsibly sourced materials. Kenya’s anti-plastic regulations and Extended Producer Responsibility (EPR) rules offer tailwinds for compliant players like SKL.

Financial health check

Let’s start with the numbers, because in valuation, storytelling means little unless the financials can follow through.

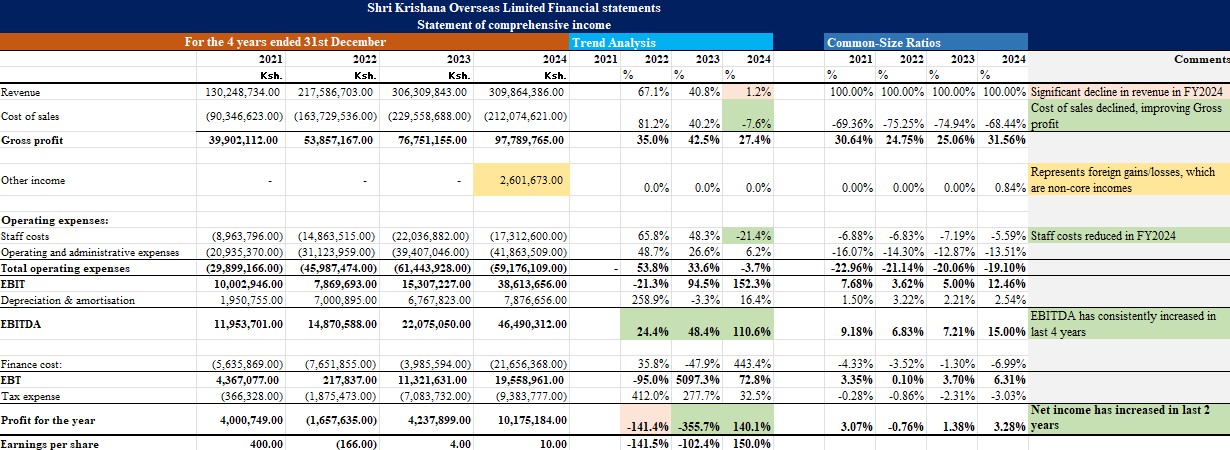

Over the 2021–2024 period, Shri Krishana Overseas PLC (SKL) has demonstrated a clear transition from a modest trading entity to a growing manufacturing business with improving operating fundamentals.

- Revenue growth & plateau: Revenues grew significantly from Ksh 130M in 2021 to over Ksh 306M in 2023, driven by the company's initial manufacturing scale-up. However, growth stalled in 2024 (+1.2%), reflecting challenging economic conditions last year, including raising cost of living and doing business, social unrest, higher interest rate, and inflation rate among others that affected sectors in which SKL operates. However, this year (2025), the interest rate is declning and inflation rate is down to 3.8%, and SKL is hopeful that this will positively influence the sectors it operates going forward, potentially improving future performance.

- Margin expansion: Despite revenue stagnation in 2024, SKL achieved a notable gross margin improvement from 25.1% (2023) to 31.6% (2024), owing to better cost controls.

- EBITDA growth: EBITDA more than doubled in 2024 to Ksh 46.5M, lifting the EBITDA margin to 15%, its highest in four years. This signals enhanced operational efficiency.

- Operating profit surge: EBIT rose to Ksh 38.6M in 2024 (12.5% margin), reversing the weaker operating results of earlier years. The firm is beginning to benefit from manufacturing scale, after overcoming early margin pressure.

- Finance costs spike: A significant jump in finance costs (Ksh 21.6M in 2024) reflects new debt financing, likely tied to the Kisaju project. As a result, interest coverage remains an area of concern.

- Net profit rebound: After a loss in 2022, net profit climbed to Ksh 10.2M in 2024, driven by stronger EBIT despite high finance charges. This marks a return to positive earnings and improved earnings quality.

- EPS volatility: Earnings per share (EPS) rebounded from negative territory in 2022 to Ksh 10 in 2024, aligning with the company’s improving profitability and cost discipline.

👉 Click to view full income statement analysis:

🏗️ Asset growth & composition

-

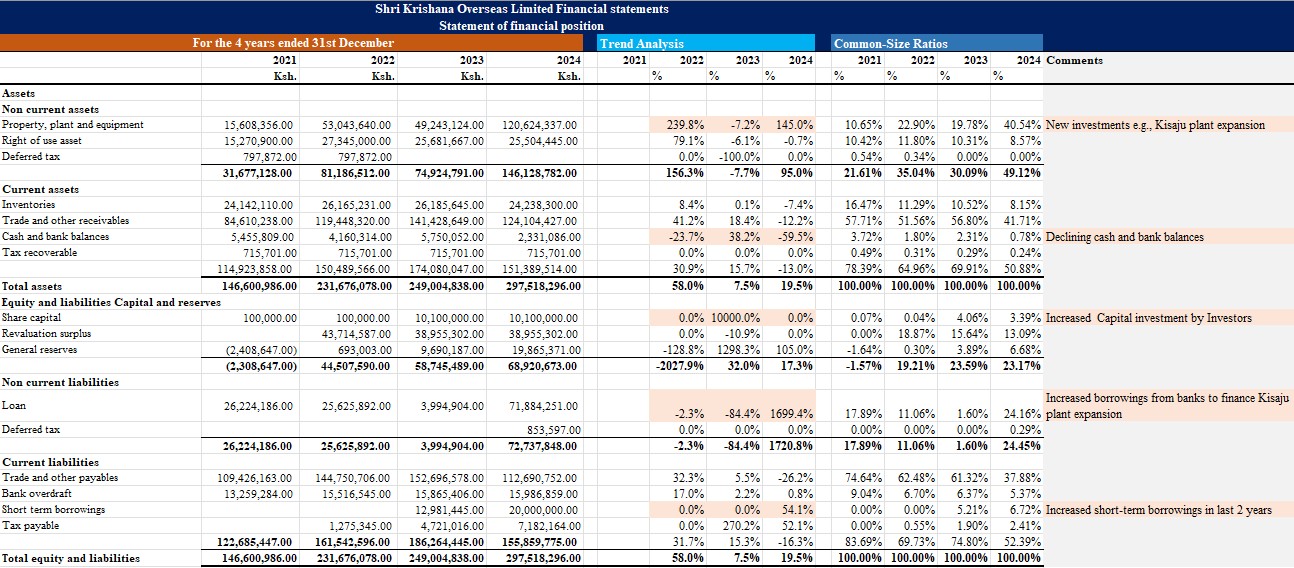

Total assets nearly doubled from Ksh 146.6M in 2021 to Ksh 297.5M in 2024, driven by heavy investment in property, plant & equipment, which surged by 145% in 2024 alone.

-

Right-of-use assets remained stable since 2022, suggesting consistent lease arrangements.

However:

-

Cash and bank balances declined by ~60% in 2024, ending at just Ksh 2.3M, signaling reduced liquidity amid capex pressure.

-

Trade receivables remain elevated (41.7% of assets in 2024), indicating extended credit cycles and potential working capital strain.

💰 Equity position & capital injection

-

Share capital jumped from Ksh 100K to Ksh 10.1M in 2023, indicating a substantial equity injection, possibly to support capital investment or improve financial standing ahead of listing.

-

General reserves improved sharply from negative territory in 2021 to Ksh 19.8M by 2024, showing retained earnings accumulation and stronger equity fundamentals.

-

Total equity grew to Ksh 68.9M by 2024, up from a negative position in 2021, reflecting a gradual strengthening of book value.

💳 Debt & liability profile

-

Long-term debt rose significantly to Ksh 71.9M in 2024, linked to Kisaju expansion, reversing a sharp decline in 2023. It now constitutes 24.2% of the balance sheet, raising leverage levels.

-

Short-term borrowings and overdrafts remained consistently high, reflecting working capital needs and potential cash flow mismatches.

-

Trade payables fell 26% in 2024, which could indicate improved payment cycles or renegotiation with suppliers.

👉 Click to view full Balance sheet statement analysis:

Growth narrative: The plant in Kisaju

No story around SKL is complete without understanding the weight placed on the Kisaju facility. The plant is designed to serve:

- Kenya’s $1B+ horticulture sector (including avocados, herbs, mangoes, and vegetables) and floriculture exports, where packaging for perishables is critical

- The growing Fast-Moving Consumer Goods (FMCG) market amid growing urban expansion and growing population.

The Kisaju plant is a bet on scale, timing, and demand. It’s a catalyst for value, but only if operationalized on time, within budget, and at sufficient utilization.

Risks and red flags

Valuation optimism should be tempered with realism. Key concerns include:

- Single-facility risk until Kisaju plant becomes operational

- High financial leverage with no hedging strategy disclosed

- Concentrated ownership among founders (Nirmla Devi and Sonvir Singh together hold 50 million shares out of 50.5 million total), raising governance flags

- Macroeconomic exposure: currency volatility, fiscal tightening, and inflation, though currently low at 3.8% as per June 2025's estimate.

Valuation: from story to numbers

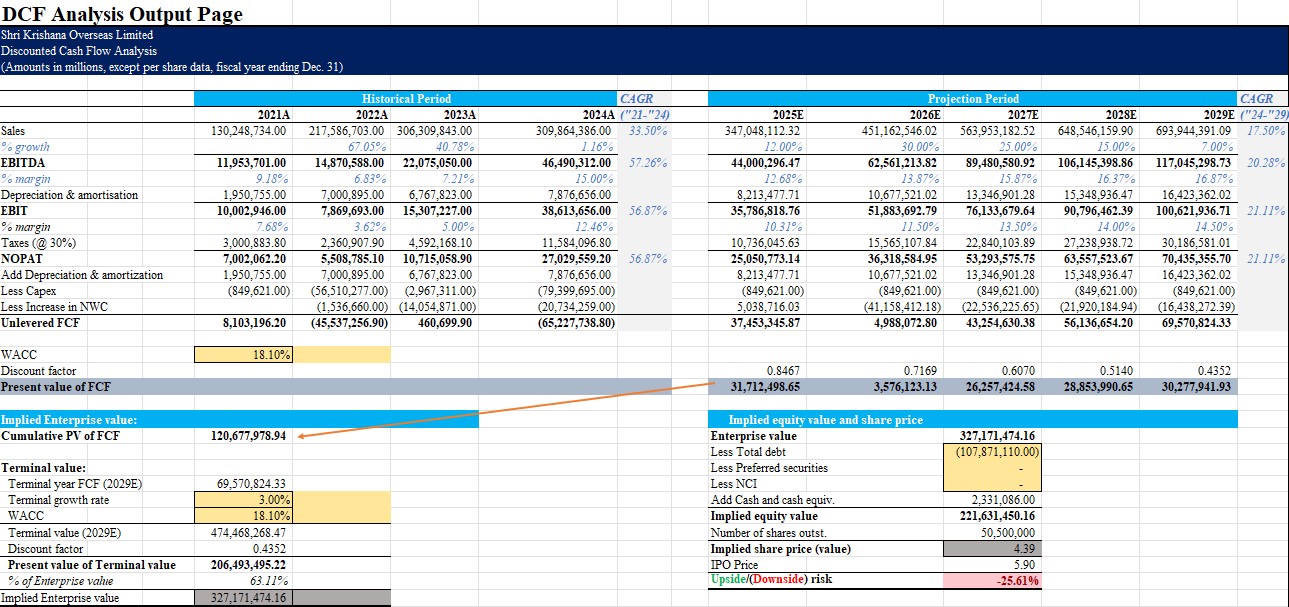

We used a Discounted Cash Flow (DCF) model to estimate intrinsic value of SKL, given the lack of NSE packaging comparables companies. The model reflects both the potential SKL’s growth trajectory but subject to execution risk.

A. Operating assumptions

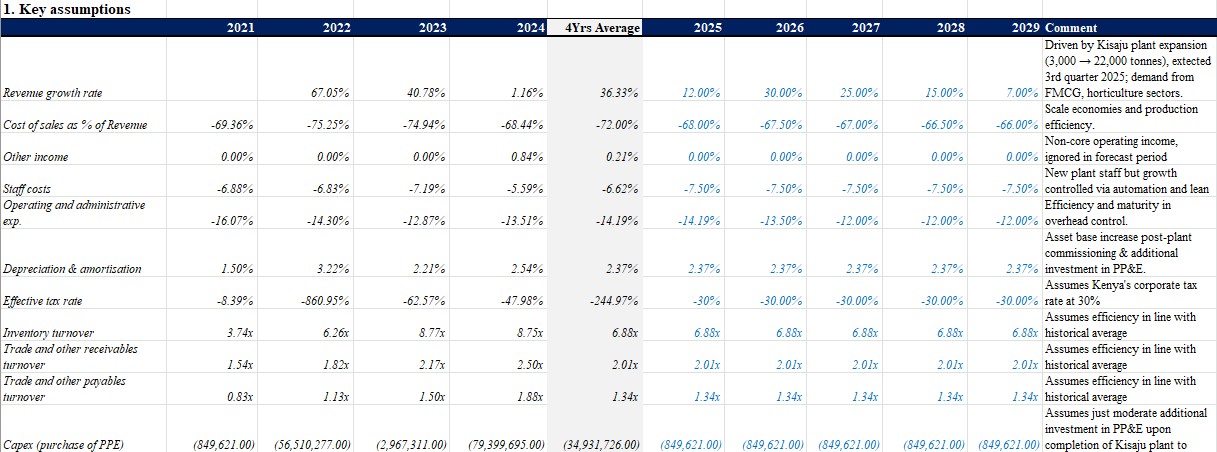

The forecast assumptions reflect a pragmatic outlook grounded in SKL's historical performance and upcoming strategic transformation.

-

Revenue growth is assumed to accelerate in 2026 (30%), driven by the commissioning of the new Kisaju plant in Q3 2025. This expansion increases installed capacity from 3,000 to 22,000 tonnes, enabling SKL to meet rising demand from FMCG, agriculture, and horticulture sectors including avocado and vegetable exports.

-

Cost of sales as a percentage of revenue is expected to gradually decline from 68% to 66% by 2029, assuming scale economies, import substitution, and improved production efficiency at the new facility.

-

Staff and operating expenses are held relatively constant as a proportion of revenue, assuming lean operations, controlled hiring, and administrative efficiency following plant automation and maturity.

-

Depreciation and amortisation stabilizes at 2.37% of revenue, reflecting capital expenditure normalization post-plant completion.

-

A 30% effective tax rate is applied consistently across forecast years, in line with Kenya’s corporate tax regime.

-

Working capital metrics- inventory turnover (6.88x), receivables turnover (2.01x), and payables turnover (1.34x), are anchored to historical averages, assuming continued operational discipline and customer/vendor terms stability.

-

Capital expenditure is significantly frontloaded in 2024 (Ksh 79.4M), associated with the Kisaju project, before tapering off to a recurring Ksh 849,621 annually, assuming only maintenance-level investment beyond FY2025.

Overall, these assumptions present a balanced view, optimistic about operational leverage and growth post-expansion, yet grounded in the realities of a gradual scale-up, competitive pressures, and capital discipline.

👉 Click to view full assumptions:

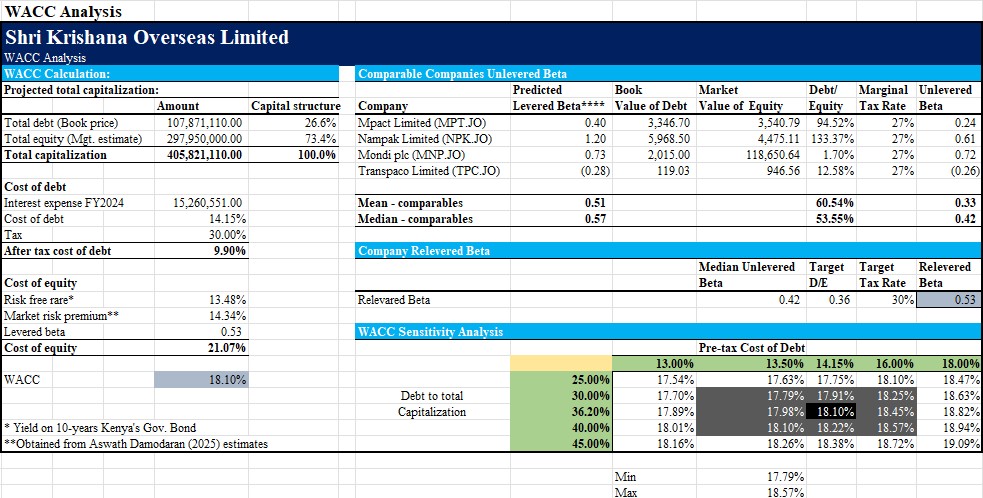

B. WACC breakdown

WACC, also known as the discount rate, is where many frontier-market valuations diverge from global norms. We approached it bottom-up:

- Risk-Free Rate: We used the Kenya 10-year Government bond yield (~13%) as a proxy. This captures local inflation and sovereign risk.

- Equity Risk Premium: Obtained from Aswath Damodaran (2025) estimates in regards to Kenya's equity market premium (~14%).

- Beta: Re-levered beta of 0.53 derived from a peer set of African packaging and light manufacturing companies (e.g., Mpact, Transpaco).

- Cost of Debt (pre-tax): 14% estimated based on effective interest rate method.

- Target Capital Structure: 73% equity / 27% debt based on post-IPO equity performance, assuming current Ksh.5.90 per share and 50,500,000 outstanding shares.

👉 Click to view full WACC assumptions:

C. DCF output

Using a five-year explicit forecast period and assuming a terminal growth rate of 3.0% and a discount rate (WACC) of 18.10%, the implied enterprise value is approximately Ksh 327.17 million, with a corresponding equity value of Ksh 221.63 million, or Ksh 4.39 per share.

This compares to an IPO listing price of Ksh 5.90, implying a 25.61% downside risk based on conservative-to-optimistic assumptions.

👉 Click to view full DCF Valuation:

Note: Based on our valuation estimates, Terminal value accounts for about 63% of total valuation, reflecting the company’s long growth runway but subject to execution risk of the new plant & sector growth.

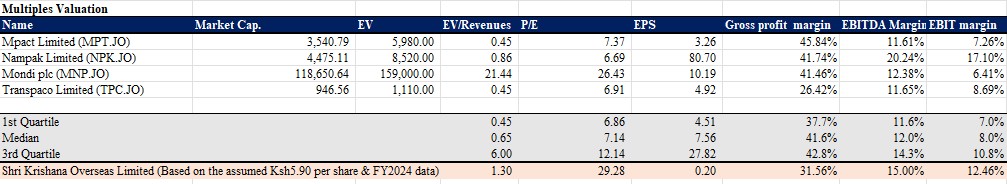

D. Market Multiples cross-check

Given the absence of listed packaging peers in Kenya, we benchmarked SKL against selected African packaging companies, most of which are large companies not the size of SKL and the list is not exhaustive. The selected companies includes Mpact, Nampak, Mondi, and Transpaco, all listed on the Johannesburg Stock Exchange.

👉 Click to view full Market Multiples Analysis:

Based on the multiples valuation, SKL’s P/E multiple of 29.28x (assuming the management estimate of Ksh.5.90 per share) places it far above the peer median of 7.14x, despite only modest earnings per share and lower than sector average gross profit margin. Its EV/Revenue of 1.30x is also on the higher end compared to the peer median of 0.65x.

This suggests that the IPO is priced optimistically relative to sector norms, although it does demonstrate stronger margins in FY2024 than peers (i.e., higher EBITDA margin and EBIT margin).

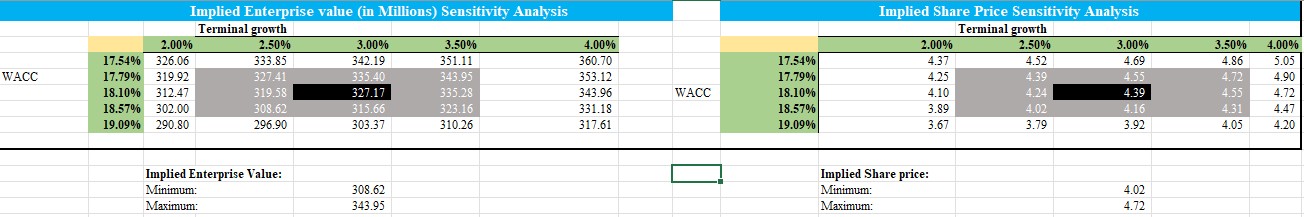

D. Sensitivity analysis (Share Price, Ksh)

Using a range of WACC (17.79%–18.57%) and terminal growth rates (2.5%–3.50%), the implied share price fluctuates between Ksh 4.02 and Ksh 4.72, with no realistic upside to the Ksh 5.90 IPO price under these assumptions.

7. The Verdict: Invest, Watch, or Wait?

The numbers tell a compelling story: while SKL's fundamentals are improving, with significant potential if the Kisaju plant is commissioned on time and performance to some extent align with its expected annual capacity, the current IPO valuation leaves little room for error. Investors are essentially paying a premium of about 25.61% for expected future margins that are not yet fully realized.

Unless SKL can significantly outperform projections, there may be more downside than upside at the current valuation.

Verdict: Watch

🟡 Watchlist-worthy: Monitor execution of Kisaju plant, margin expansion, and deleveraging post-2026

🔴 Not yet investable: Valuation too tight vs. risk-adjusted return

🟢 Upside scenario: If growth targets and cost efficiencies hold, SKL could emerge as a high-quality compounder by 2027+

📌 ApexHub Insights provides data-driven research and equity narratives on African markets. Follow us for deep dives into emerging investment stories. Disclaimer: This valuation is provided for information purposes only and does not constitute a financial advice. Consult your financial advisor before making any investment decisions. Read more about this disclaimer here