Sanlam Kenya’s Net Profit Slumps 89% in H1 2025 Despite Strong Investment Returns

Sanlam H1 2025 Results Show Weak Profitability Amid Strong Investments

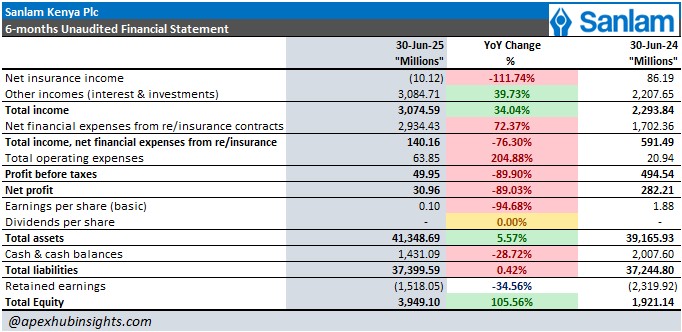

Sanlam Kenya Plc (SLAM) has announced its unaudited financial results for the six months ended June 30, 2025, reflecting a mixed performance. While the company benefited from strong investment income, profitability came under severe pressure from higher finance expenses from insurance contracts and a collapse in core insurance income.

The insurer recorded a net profit of KSh 30.96 million, down 89.03% year-on-year from KSh 282.21 million in H1 2024. Pre-tax profit dropped almost 90% to KSh 49.95 million, underlining the challenging operating environment.

Investment Income the Key Growth Driver

Sanlam’s topline was largely supported by interest and investment income, which surged 39.73% to KSh 3.08 billion from KSh 2.21 billion a year earlier.

However, this was overshadowed by the collapse in insurance underwriting, with net insurance income slipping into a loss of KSh 10.12 million compared to a gain of KSh 86.19 million in 2024.

Additionally, net financial expenses from re/insurance contracts jumped 72.37% to KSh 2.93 billion, significantly eroding income. As a result, total income net of finance expenses from re/insurance fell 76.30% to KSh 140.16 million.

Expenses, Profitability, and Shareholder Value

The company did not managed to keep operating expenses broadly stable, as operating expenses increased by 204.8% to Ksh 63.85 million compared to last year.

This sharp increase in operating expenses further drove profit levels down. Earnings per share fell 94.68% to KSh 0.10 partly due to profit decline and nearly 4 times increase in shares outstanding to 543.42 million.

The board did not declare any interim dividend, consistent with prior practice. The share of the company was trading at Ksh 8.20 per share in early morning, 21st August 2025, down by 9.89% partly due to declining profitability performance.

- To track upcoming dividends of other companies in Kenya, click here.

Balance Sheet and Equity Growth

Sanlam’s balance sheet expanded moderately, with total assets rising 5.57% to KSh 41.35 billion. Liquidity weakened, however, as cash and cash balances fell 28.72% to KSh 1.43 billion.

On a positive note, total equity more than doubled to KSh 3.95 billion (up 105.56%), supported by a reduction in retained losses, while liabilities remained nearly flat at KSh 37.40 billion.

Ratios Highlight Profitability Pressure

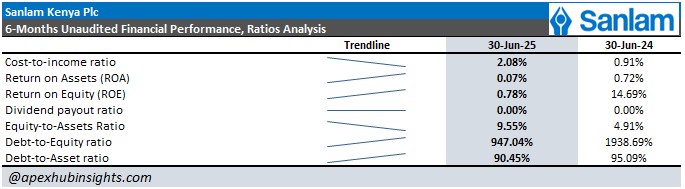

Sanlam’s ratios underscore the stark divergence between balance sheet growth and profitability:

- Cost-to-income ratio rose to 2.08% (from 0.91%).

- Return on Assets (ROA) collapsed to 0.07%, down from 0.72%.

- Return on Equity (ROE) plummeted to 0.78%, compared to 14.69% in H1 2024.

- Equity-to-assets ratio improved to 9.55% (from 4.91%), highlighting stronger capitalization.

- Debt-to-equity ratio fell sharply to 947.04% from 1,938.69%, reflecting reduced leverage.

- Debt-to-assets ratio improved to 90.45% from 95.09%.

Investor Outlook: Stability but Limited Returns

From an investor standpoint, Sanlam’s H1 2025 results highlight financial stability through improved equity and reduced leverage. However, profitability has deteriorated significantly, with earnings capacity constrained by underwriting losses and high finance expenses from insurance contracts.

While investment income remains a key buffer, the company must focus on restoring core insurance profitability and managing claims costs to deliver sustainable returns. In the near term, investors may find value in Sanlam’s balance sheet strengthening, but returns remain limited, with dividends unlikely until profitability recovers.