Standard Chartered Bank Kenya Reports 21% Profit Decline in H1 2025, Maintains Interim Dividend Payout

Standard Chartered Bank Kenya Half-Year 2025 Results Reflect Profit Pressure

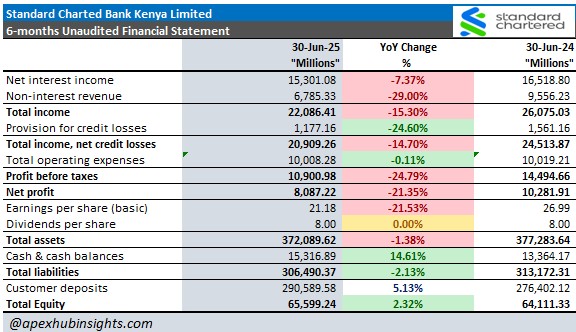

Standard Chartered Bank Kenya Limited (SCBK) has released its unaudited financial results for the six months ended June 30, 2025, showing a decline in profitability amid a slowdown in income streams.

The lender’s net profit fell 21.35% to KSh 8.09 billion, compared to KSh 10.28 billion in the same period last year. Earnings per share dropped by 21.53% to KSh 21.18, underscoring the impact of weaker revenue growth and pressure on operational performance.

Income Declines Weigh on Profitability

The Bank’s net interest income declined 7.37% to KSh 15.30 billion, reflecting compressed margins and softer lending activity. More significantly, non-interest revenue fell 29.00% to KSh 6.79 billion, weighed down by reduced transactional activity and lower fees and commissions.

This saw total income contract by 15.30% to KSh 22.09 billion. Even with a 24.60% drop in credit loss provisions to KSh 1.18 billion, net income after provisions stood at KSh 20.91 billion, down 14.70% from H1 2024.

Operating expenses remained largely flat at KSh 10.01 billion, but the decline in income drove a 24.79% reduction in profit before tax, which stood at KSh 10.90 billion compared to KSh 14.49 billion last year.

Balance Sheet and Capital Position

The Bank’s total assets slipped 1.38% to KSh 372.09 billion, while customer deposits increased 5.13% to KSh 290.59 billion, highlighting continued trust from depositors despite earnings pressure. Total equity rose modestly by 2.32% to KSh 65.60 billion, reinforcing a steady capital base.

Cash and cash balances expanded by 14.61% to KSh 15.32 billion, suggesting stronger short-term liquidity positioning even as overall balance sheet growth slowed.

Ratio Analysis Signals Weaker Efficiency and Returns

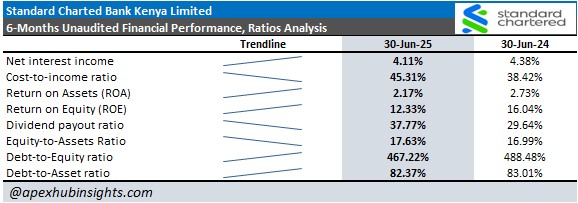

Key performance ratios revealed stress on efficiency and profitability:

- Cost-to-income ratio rose to 45.31% from 38.42%, reflecting deteriorating efficiency.

- Return on Assets (ROA) declined to 2.17% from 2.73%.

- Return on Equity (ROE) weakened to 12.33%, down from 16.04%.

- Equity-to-assets ratio improved slightly to 17.63% from 16.99%.

- Debt-to-equity ratio eased to 467.22% from 488.48%, showing marginally lower leverage.

Interim Dividend Maintained at KSh 8 Per Share

In a move to reassure shareholders, the Board declared an interim dividend of KSh 8 per share, unchanged from the prior year. Despite the fall in earnings, this decision reflects the Bank’s commitment to sustaining shareholder returns. Asa result, the dividend payout ratio rose to 37.77% from 29.64% last year, signaling a higher portion of earnings being distributed. The Share price closed at Ksh335 on 20th August, 2025, a drop of 1.90% during the day following the announcement.

- To track upcoming dividends of Standard Chartered Bank and other companies in Kenya, click here.

Investor Outlook: Dividend Stability Amid Earnings Pressure

From an investor perspective, the half-year results highlight a challenging operating environment for Standard Chartered Kenya, marked by weaker income performance and declining profitability ratios and this has contributed to its share price drop on 20th August, 2025.

However, the decision to maintain the interim dividend underscores the Bank’s confidence in its capital buffers and liquidity, offering some stability for shareholders. The rising dividend payout ratio may also be interpreted as a signal of management’s willingness to prioritize investor confidence, even in a half year of earnings contraction.

Looking ahead, investors will closely watch the Bank’s ability to revive non-interest income growth, manage efficiency, and safeguard margins in the face of sector competition and macroeconomic headwinds.

- To find more about SCBK's historical performance, click here.