Stanbic Holdings Plc Reports Notable Profit Decline Amidst Challenging Operating Environment in H1 2025

Stanbic Holdings Plc Half-Year Results Reveal Mixed Performance

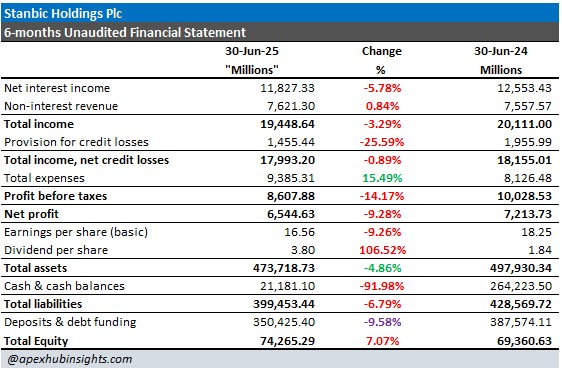

NAIROBI, Kenya - Stanbic Holdings Plc has released its unaudited financial statements for the first half of 2025, revealing a mixed performance. The company experienced a decline in key revenue streams and profitability, though it also demonstrated growth in its equity base and an increase in dividend per share.

Financial Performance Analysis

The company’s Net profit for the period decreased by 9.28%, settling at KSh 6.54 billion compared to KSh 7.21 billion in the first half of 2024. This was primarily influenced by a 3.29% drop in total income, which amounted to KSh 19.45 billion. Both primary income sources saw declines, with net interest income falling by 5.78% to KSh 11.83 billion and non-interest revenue showing a slight increase of 0.84% to KSh 7.62 billion, a minor offset to the overall income drop.

However, the bank managed to significantly reduce its provision for credit losses by 25.59% to KSh 1.46 billion, which helped to temper the impact of the income decline on the overall results. Despite this, total expenses increased by 15.49% to KSh 9.39 billion, further contributing to the 14.17% drop in profit before taxes, which came in at KSh 8.61 billion.

- To find more about Stanbic's historical performance, click here.

Key Ratios and Balance Sheet Highlights

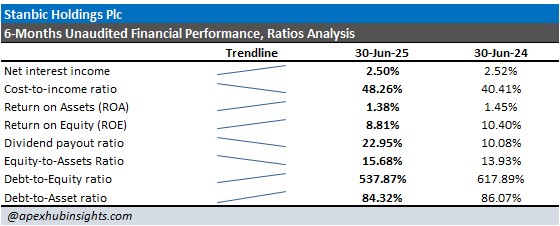

The financial data highlights shifts in key efficiency and profitability ratios. The cost-to-income ratio worsened to 48.26% from 40.41% in H1 2024, indicating a decrease in operational efficiency. Return on Assets (ROA) and Return on Equity (ROE) both declined, falling to 1.38% and 8.81%, respectively, from 1.45% and 10.40% in the previous year.

On the balance sheet, total assets decreased by 4.86% to KSh 473.72 billion. Similarly, total liabilities contracted by 6.79% to KSh 399.45 billion, with a 9.58% drop in deposits and debt funding. In a positive turn, total equity grew by 7.07% to KSh 74.27 billion, a sign of increased shareholder value. The dividend per share saw a substantial increase of 106.52% to KSh 3.80, reflecting a higher payout ratio of 22.95%.

- To track upcoming dividends of Stanbic, click here.

Conclusion

Stanbic Holdings Plc's H1 2025 results present a complex financial picture. The company faced challenges with declining total income and rising expenses, which impacted its profitability and key performance ratios like ROA and ROE. However, a significant reduction in credit loss provisions and a strong growth in total equity demonstrate a degree of resilience and a healthy balance sheet. The more than doubled dividend per share suggests management's confidence in the company’s future despite the current headwinds, indicating a strategic focus on rewarding shareholders while navigating a difficult economic landscape.