Diamond Trust Bank Posts 13% Pre-Tax Core Profit Growth Despite Decline in Non-Interest Income in H1 2025

DTB Half-Year 2025 Results Show Mixed Performance

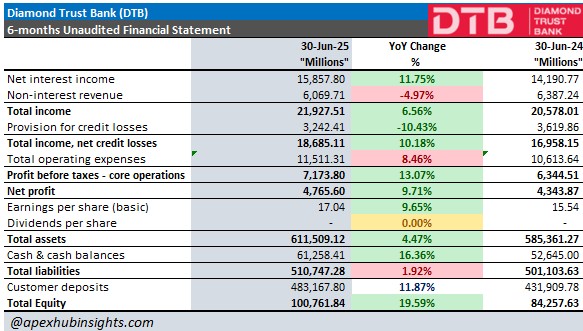

Diamond Trust Bank (DTB) has released its unaudited financial results for the six months ending June 30, 2025, reflecting a mixed performance marked by solid income growth and capital strengthening, but also rising costs and weaker efficiency metrics.

The lender posted a core profit before tax of KSh 7.17 billion (profit after tax after accounting for share of profit from associates & other non-core activities: Ksh.7,182.41), up 13.07% from KSh 6.34 billion in H1 2024. In addition, after accounting for tax effects, net profit came in at KSh 4.77 billion, representing a 9.71% increase year-on-year, highlighting improving performance even though relatively at lower rate than core profit. This was largely due to increase in current tax by more than 3 times to Ksh.2,664.85 when compared to the same period last year.

Income Growth Led by Net Interest

DTB’s results were largely underpinned by net interest income, which rose 11.75% to KSh 15.86 billion compared to KSh 14.19 billion a year earlier, reflecting stronger lending activity and improved asset yields.

In contrast, non-interest revenue declined 4.97% to KSh 6.07 billion, largely due to decline in foreign exchange trading income, whch was down by 41.42% to Ksh 1.53 bllion compared to same period last year. This limited overall income growth, with total income rising by only 6.56% to KSh 21.93 billion.

Credit quality trends offered some relief, as provisions for credit losses dropped 10.43% to KSh 3.24 billion, boosting net income after provisions to KSh 18.69 billion, a 10.18% year-on-year increase.

Rising Costs and Profitability

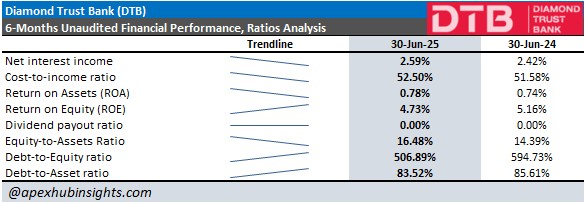

While income growth was positive, operating expenses increased 8.46% to KSh 11.51 billion, outpacing overall income growth and keeping the cost-to-income ratio elevated at 52.50% compared to 51.58% in H1 2024.

This contributed to profit pressures, with post-tax earnings showing a marked decline. Nonetheless, earnings per share rose 9.65% to KSh 17.04, reflecting higher income allocated across DTB’s shareholder base.

The bank did not declare an interim dividend for the period, in line with its historical stance of conserving capital to support long-term growth and balance sheet resilience during the first half of the year. Despite this, the share price closed at Ksh 87.25, up by 0.29% following the announcement on 20th 2025.

- Find more on upcoming dividends of other companies in Kenya here.

Balance Sheet and Capital Strengthening

DTB’s balance sheet continued to expand steadily. Total assets rose 4.47% to KSh 611.51 billion. This performance was further supported by a 11.87% increase in customer deposits to KSh 483.17 billion, indicating strong depositor confidence.

Cash and cash balances grew 16.36% to KSh 61.26 billion, enhancing liquidity. Meanwhile, total equity rose sharply by 19.59% to KSh 100.76 billion, reflecting retained earnings and a stronger capital base.

Ratios Point to Pressure on Returns

Despite topline improvements, the bank’s profitability ratios showed some weakness:

- Cost-to-income ratio worsened slightly to 52.50% (from 51.58%).

- Return on Assets (ROA) improved to 0.78 from 0.74%, indicating a marginal improvement.

- Return on Equity (ROE) fell to 4.73%, down from 5.16%, indicating weaker returns to shareholders.

- Equity-to-assets ratio improved to 16.48%, from 14.39%, signaling stronger capitalization.

- Debt-to-equity ratio fell to 506.89% (from 594.73%), reflecting reduced leverage.

- Debt-to-assets ratio improved to 83.52% from 85.61%.

Investor Outlook: Growth with Caution

From an investor perspective, DTB’s H1 2025 performance demonstrates resilient income growth and solid capital strengthening, positioning the bank for stability in a competitive sector. The decline in credit provisions further highlights cautious and improved risk management.

However, rising costs, pressure on non-interest income, and weaker ROE suggest that profitability efficiency remains a challenge. The absence of an interim dividend also reflects management’s strategy of prioritizing balance sheet resilience and long-term growth over short-term shareholder payouts.

Looking ahead, DTB’s focus on growing deposits, improving fee income streams, and managing expenses will be critical to restoring stronger profitability ratios and delivering sustainable investor value.

- To find more about SCBK's historical performance, click here.